FCA’s 2024-2025 Assertive Stance: Tougher on Firms, Safer for Consumers

The

Financial Conduct Authority (FCA) has released its Business Plan for the 2024-2025

financial year, outlining a comprehensive work program to improve consumer and market outcome.

This plan

marks the final year of the FCA’s three-year strategy to prevent serious harm,

set higher standards, and promote competition in the financial sector.

The FCA’s

priorities for the upcoming year include protecting consumers by ensuring firms

meet the high standards set by the Consumer Duty, supporting long-term

financial wellbeing through the Advice Guidance Boundary Review, and ensuring

pension products deliver value for money.

The

regulator aims to contribute to UK competitiveness and growth by improving

the attractiveness and reach of UK wholesale markets, supporting firms to

invest, innovate, and expand through its innovation services, and streamlining

the authorization process for firms.

“We’ve

already made significant progress in delivering against the bold vision we set

out in our strategy two years ago, including the game-changing introduction of

the Consumer Duty and proposing the most far-reaching reforms to wholesale

market regulation and the listing regime in decades,” Nikhil Rathi, the Chief

Executive of the FCA, commented.

Source: FCA

In

addition, the FCA plans to build on its progress towards becoming a world-class

data-led regulator by automating more of its analytics tools to swiftly identify and address risks to consumers, while collaborating with firms to deploy artificial intelligence safely.

We’ve set out an ambitious programme of work to achieve better outcomes for consumers and markets, while supporting UK competitiveness. #FinancialServices #FinancialRegulation #Markets #ConsumerProtection #ConsumerDuty https://t.co/1N1xv9cTE6 pic.twitter.com/rU33goPGlt

— Financial Conduct Authority (@TheFCA) March 19, 2024

“We could do none of this without our people. To help meet our growing remit, our workforce will be more than 5,000 by the end of March 2024. We continue to focus on ensuring we have the right skills to achieve our business objectives sustainably,” the regulator stated in its strategy.

FCA Shows Results of Its Actions

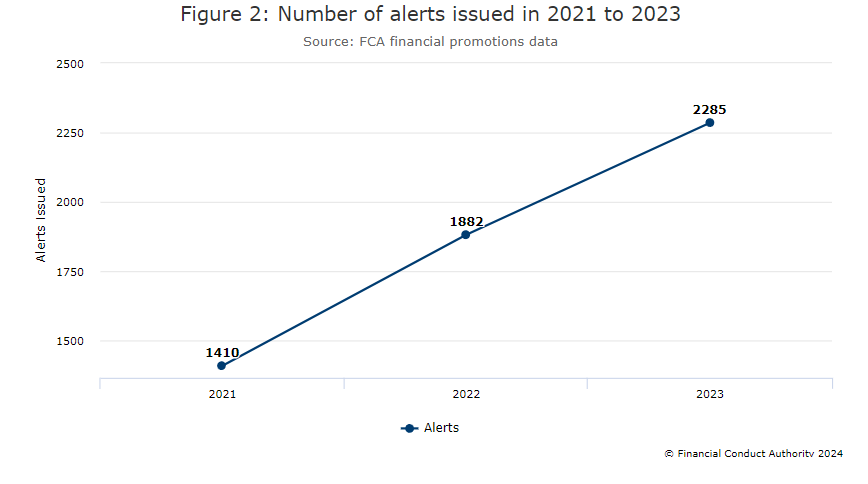

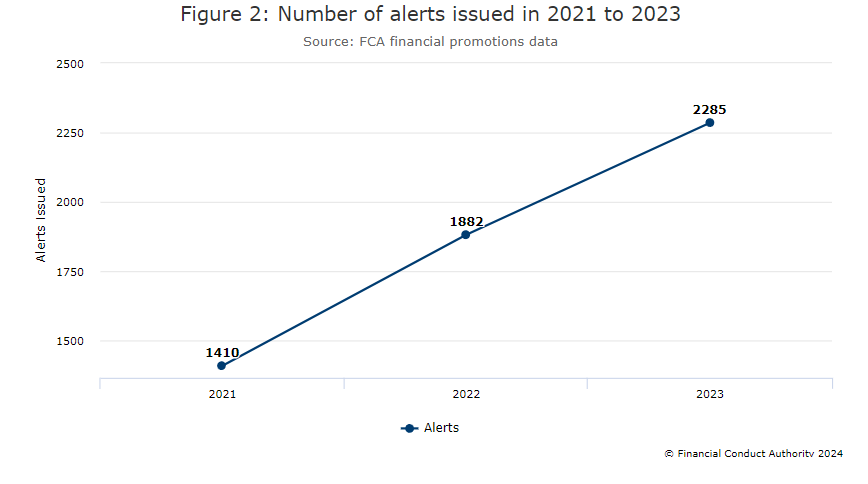

The FCA’s

assertive approach has already yielded results, with the regulator removing

over 10,000 potentially misleading adverts in 2023 and sending out 2,243

warnings about unauthorized firms and individuals.

Source: FCA

“People need clear, fair, and accurate information on which to base their financial decisions. We will continue to intervene and take action when we identify firms not meeting our minimum standards,” said Lucy Castledine, the FCA’s Director of Consumer Investments.

Back in late December, the FCA revealed that it canceled almost 1,300 unauthorized firms in 2023 and imposed record fines totaling £52,802,900. The number of firm permissions revoked more than doubled compared to the previous year because they failed to meet its minimum standards.

In response to growing concerns about debt collection practices amidst rising living costs, the UK’s regulator has recently teamed up with Ofgem, Ofwat, and Ofcom. This collaboration aims to address these concerns by setting out clear expectations for businesses in various sectors, prioritizing the strengthening of consumer protection measures.

The

Financial Conduct Authority (FCA) has released its Business Plan for the 2024-2025

financial year, outlining a comprehensive work program to improve consumer and market outcome.

This plan

marks the final year of the FCA’s three-year strategy to prevent serious harm,

set higher standards, and promote competition in the financial sector.

The FCA’s

priorities for the upcoming year include protecting consumers by ensuring firms

meet the high standards set by the Consumer Duty, supporting long-term

financial wellbeing through the Advice Guidance Boundary Review, and ensuring

pension products deliver value for money.

The

regulator aims to contribute to UK competitiveness and growth by improving

the attractiveness and reach of UK wholesale markets, supporting firms to

invest, innovate, and expand through its innovation services, and streamlining

the authorization process for firms.

“We’ve

already made significant progress in delivering against the bold vision we set

out in our strategy two years ago, including the game-changing introduction of

the Consumer Duty and proposing the most far-reaching reforms to wholesale

market regulation and the listing regime in decades,” Nikhil Rathi, the Chief

Executive of the FCA, commented.

Source: FCA

In

addition, the FCA plans to build on its progress towards becoming a world-class

data-led regulator by automating more of its analytics tools to swiftly identify and address risks to consumers, while collaborating with firms to deploy artificial intelligence safely.

We’ve set out an ambitious programme of work to achieve better outcomes for consumers and markets, while supporting UK competitiveness. #FinancialServices #FinancialRegulation #Markets #ConsumerProtection #ConsumerDuty https://t.co/1N1xv9cTE6 pic.twitter.com/rU33goPGlt

— Financial Conduct Authority (@TheFCA) March 19, 2024

“We could do none of this without our people. To help meet our growing remit, our workforce will be more than 5,000 by the end of March 2024. We continue to focus on ensuring we have the right skills to achieve our business objectives sustainably,” the regulator stated in its strategy.

FCA Shows Results of Its Actions

The FCA’s

assertive approach has already yielded results, with the regulator removing

over 10,000 potentially misleading adverts in 2023 and sending out 2,243

warnings about unauthorized firms and individuals.

Source: FCA

“People need clear, fair, and accurate information on which to base their financial decisions. We will continue to intervene and take action when we identify firms not meeting our minimum standards,” said Lucy Castledine, the FCA’s Director of Consumer Investments.

Back in late December, the FCA revealed that it canceled almost 1,300 unauthorized firms in 2023 and imposed record fines totaling £52,802,900. The number of firm permissions revoked more than doubled compared to the previous year because they failed to meet its minimum standards.

In response to growing concerns about debt collection practices amidst rising living costs, the UK’s regulator has recently teamed up with Ofgem, Ofwat, and Ofcom. This collaboration aims to address these concerns by setting out clear expectations for businesses in various sectors, prioritizing the strengthening of consumer protection measures.

Comments are closed.