dLocal: A Young Payments Business For The Watchlist

By Anirban Mahanti

Uruguay-based dLocal DLO specializes in payments processing for global merchants operating in emerging markets. The company operates in 39 countries across Latin America, the Middle East, Africa, and Asia Pacific. Using dLocal’s “One dLocal” platform, global businesses can accept payments, send “payouts,” and settle funds globally without requiring multiple payment acquirers and methods. In other words, dLocal can be a one-stop payments shop for multinationals in emerging countries.

Why Should Investors Consider dLocal?

There are many reasons, but I would broadly classify them under opportunity, business model, profitability, and valuation.

First, emerging markets comprise some of the fastest-growing economies in the world. Together, these account for 50% of the global GDP. Ignoring these countries is no longer an option. However, the payment rails, preferences of consumers, and regulations vary across these countries, making it a challenge for multinational businesses. A company like dLocal that addresses these problems across multiple markets via one easy-to-use platform is likely very appealing to global merchants.

Second, payments as a business model have many appealing characteristics. Payments companies are like “toll booths” that collect a fee (a toll) on transactions flowing through its payment highway. A byproduct of this setup is operating leverage at scale. Essentially, there is an upfront cost to set up the infrastructure. Once everything has been set up, each incremental transaction flowing through the platform brings in additional revenue at little to no cost. At scale, payments as a business can be hugely profitable, as illustrated by the sky-high free cash flow margin of stalwarts such as MasterCard MA and Visa V.

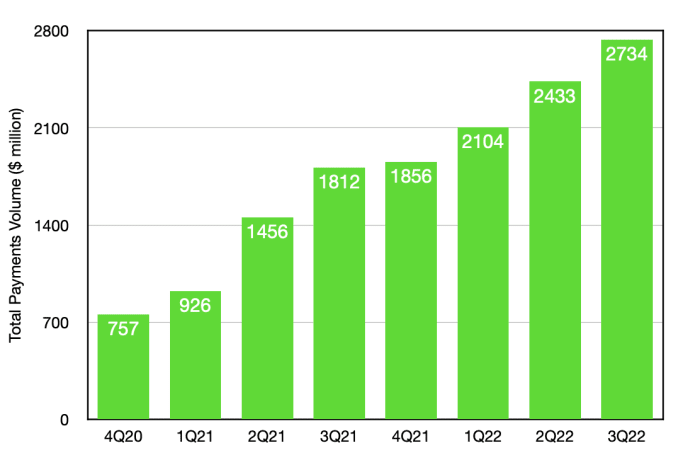

dLocal is a young company, nowhere near the scale of a MasterCard or Visa. However, dLocal is growing quickly and doing so profitably. Recently reported Q3 2022 earnings had total payment volume (TPV) come in at $2.7 Billion, up 51% year-over-year. The company delivered revenue of $112 million for the quarter, up 63% over the prior year, with adjusted EBITDA growing 58% year-over-year to $42 million.

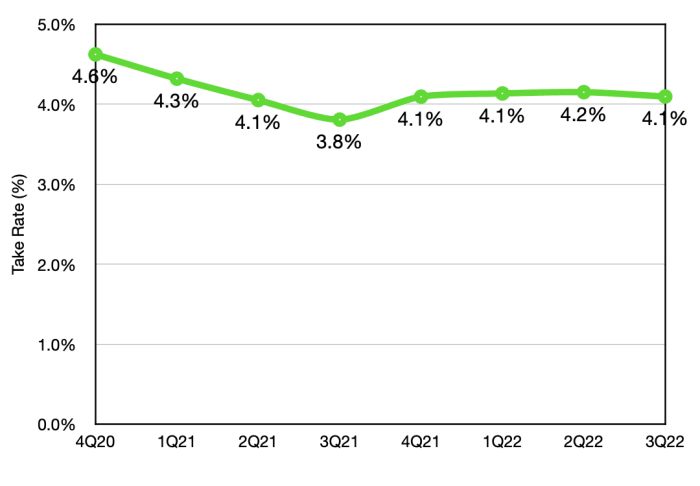

Part of the company’s success is in its ability to land and expand customers over time, while maintaining a relatively low churn rate. Take rate, which is revenue as a percentage of TPV, has also remained relatively stable over time.

With a total payment processing run rate of $10 billion, dLocal has barely scratched the surface of its mammoth opportunity. Management believes its addressable market, in payment processing volume terms, is $1 trillion. Instead of focusing on such large numbers, it might be more reasonable to expect high growth of payment processing volume to continue over the medium term. With steady execution, the business should reach a $100 annual payment processing run rate over the next decade and still have the option of growing at a rapid clip.

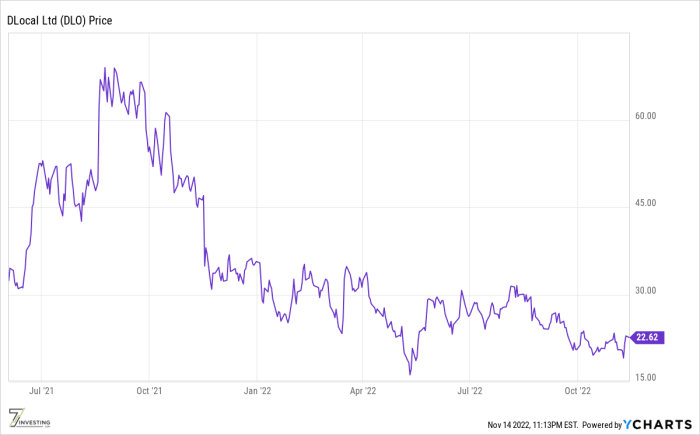

The company’s initial public offering in June 2021 priced the shares at $21. The stock had a run-up to the high $ 60s and is now trading close to its IPO price. The company’s execution since its IPO has been solid, but dLocal has been shellacked just like the rest of the growth stocks.

With a trailing twelve-month earnings per share (EPS) of $0.37, dLocal is currently selling for 60-times trailing earnings. That might not sound like a good deal at first glance, but it might be appealing if the company can continue growing its TPV, maintain its take rate (i.e., revenue as a percentage of TPV), and take advantage of its capital-light business model to generate outsized earnings growth.

About the author: Anirban Mahanti is a lead advisor for 7investing. Before 7investing, Anirban spent 5-plus years at The Motley Fool’s Australian subsidiary in various roles, including as the Director of Research and the founding lead advisor of the market-beating small-cap ASX stock-picking newsletter Extreme Opportunities. You can follow Anirban on Twitter by clicking this link.

Comments are closed.